View:

May 06, 2024

Asia Open - Overnight Highlights

May 6, 2024 12:00 AM UTC

EMERGING ASIA

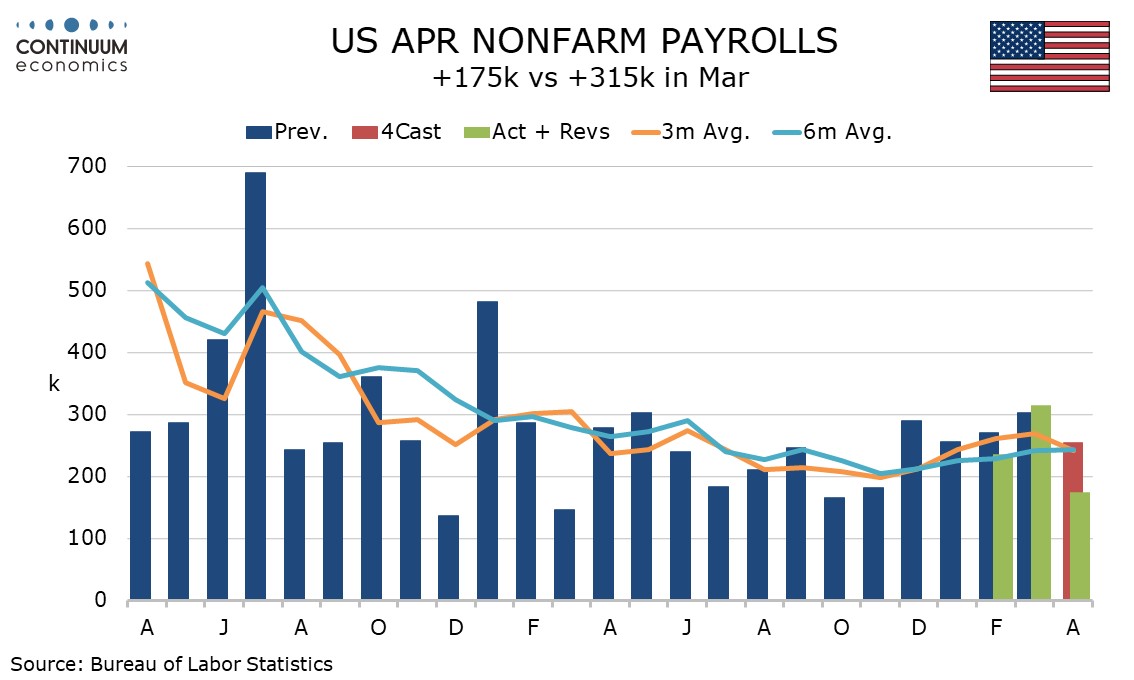

EM currencies perform mostly stronger against the USD as the greenback slipped on weaker than expected payroll data. KRW saw the largest gains of 0.94%, followed by IDR 0.63%, THB 0.43%, SGD 0.39%, TWD 0.36%, MYR 0.34%, PHP 0.31%, CNH 0.19%, INR 0.04% and HKD 0.02%.

USD/CNH is trading lo

May 05, 2024

May 03, 2024

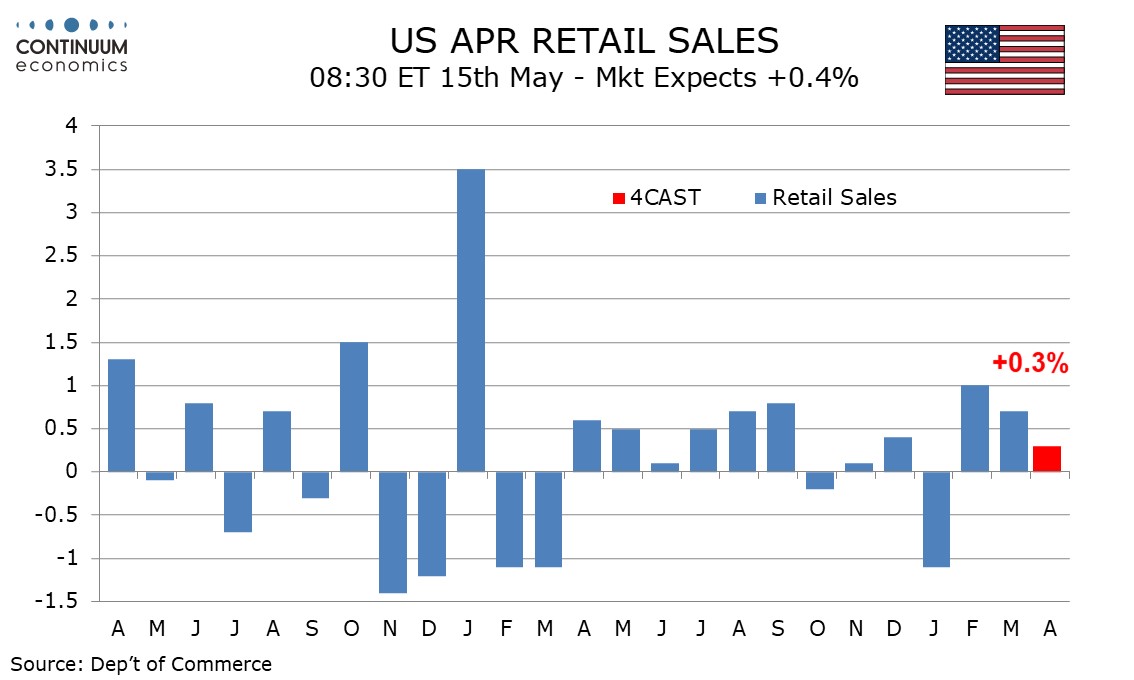

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 3, 2024 5:00 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

U.S. April ISM Services - Weakness may be overstated

May 3, 2024 2:24 PM UTC

April’s ISM services index of 49.4 from 51.4 has fallen below neutral for the first time since December 2022. That dip was explained by bad weather. There is no obvious erratic factor here to explain the weakness, but the details suggests that weakness may be overstated.

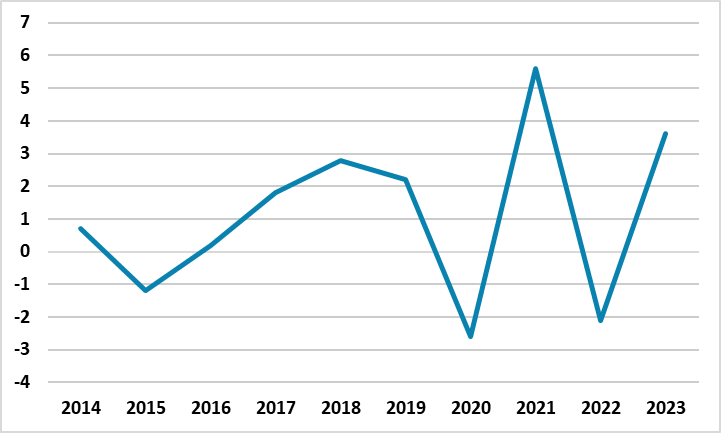

Russian Economy Expands by 4.2% YoY in March, and 5.4% in Q1

May 3, 2024 2:14 PM UTC

Bottom Line: According to the figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 4.2% YoY in March owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We now foresee Russian economy will expand by 2.6% in 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

FX Daily Strategy: N America, May 3rd

May 3, 2024 9:04 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: Europe, May 3rd

May 3, 2024 5:57 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady